Trading With Microsoft Excel Spreadsheets

HOW TO CREATE A SIMILAR CHART WITH MICROSOFT EXCEL,

1. Go online and follow the many directed instruction sites which will show you and tell you how to construct it.

If you are curious, you can Google “How To Shade An Area Between 2 Lines in Excel” and if you do so, you will receive many many web sites that will help you do this.

2. Or, the easy way, use our example Excel spreadsheet to get started. Simply download the Excel spreadsheet at the bottom of the page and then plug in your own price data, calculation data , etc. (NO VBA, and NO MACROS involved).

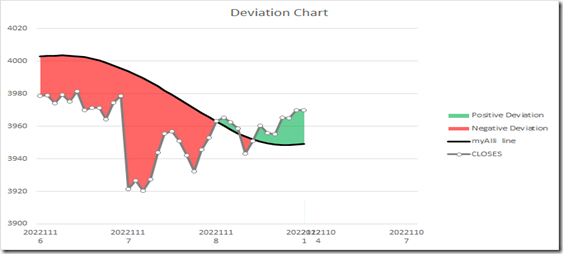

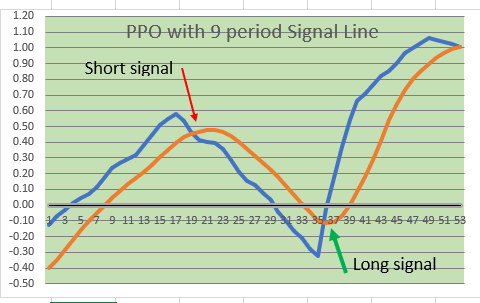

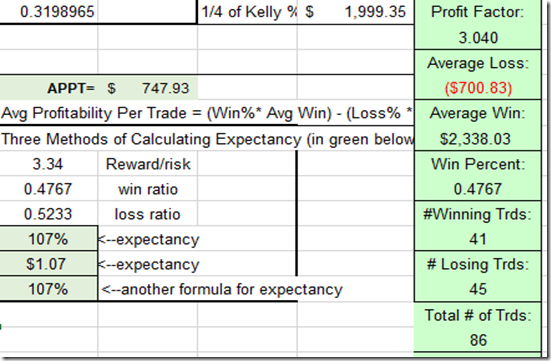

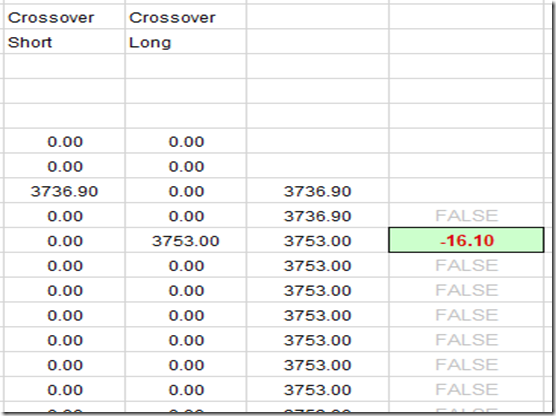

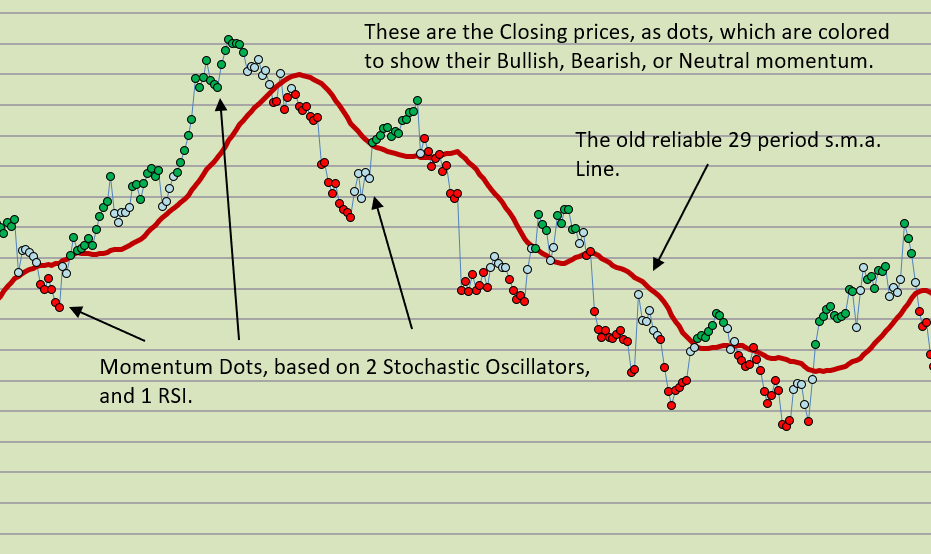

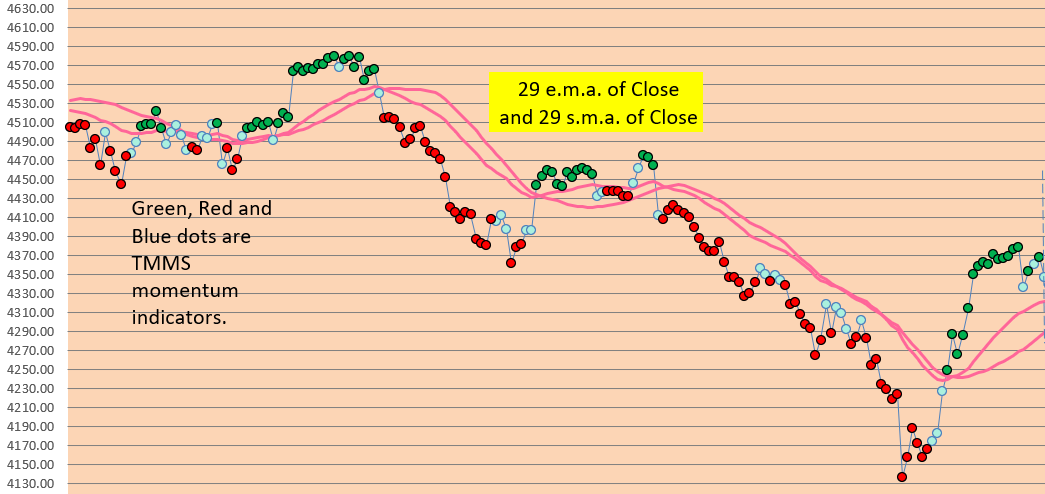

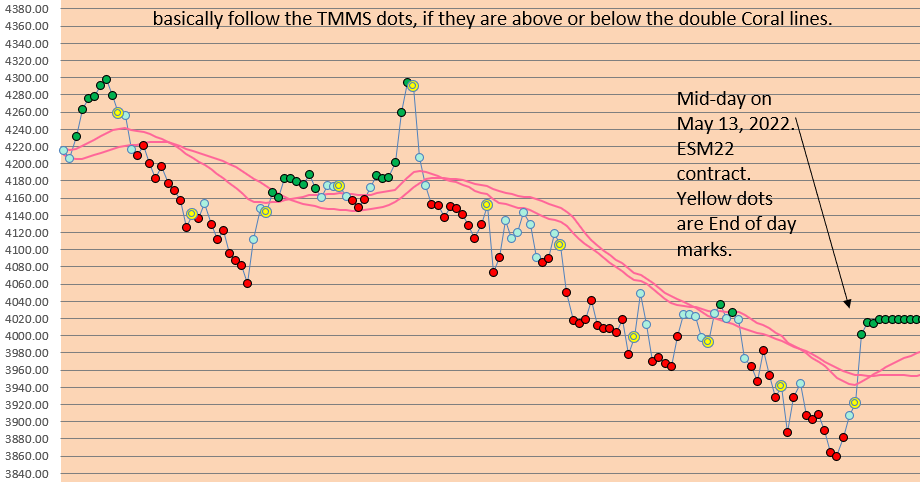

As Excel based traders, we rely on visual charts made with Excel for our trading decisions, our entries and exits. The better we can visualize the areas of Trend Breakout or momentum, either up or down, then the better we can execute trades and take advantage of sustained price moves, whether they be intraday or longer term.

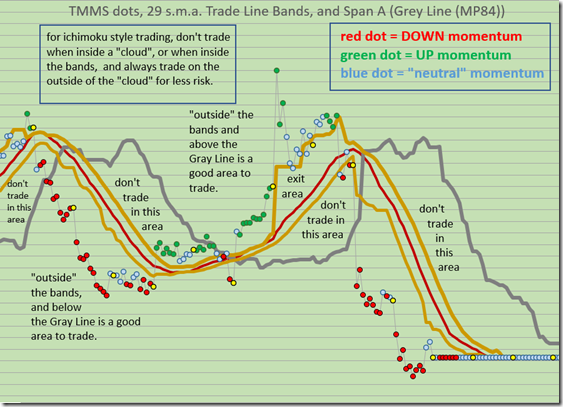

For example, we may use a couple of moving averages to signify a “No Trade Zone” vs a “Yes Trade Zone”, which are essentially PERMISSION BOUNDARIES.

Or we may use particular Ichimoku Lines to show us where we need to exit trades to prevent losses or lock in a profitable trade.

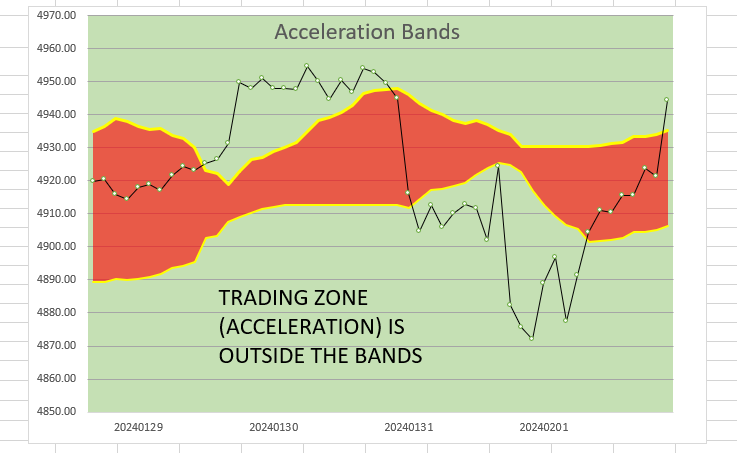

Or we may use a couple of Acceleration Band Lines to demonstrate a boundary between ordinary price movement and accelerated price movement. These are just our uses and yours may be variable as well.

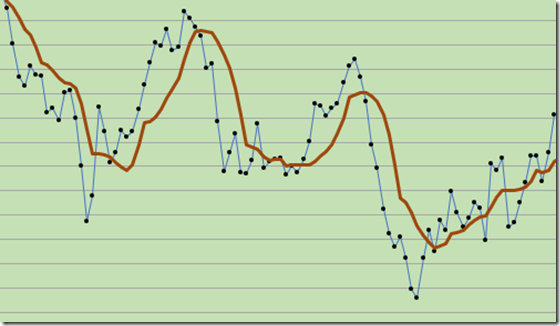

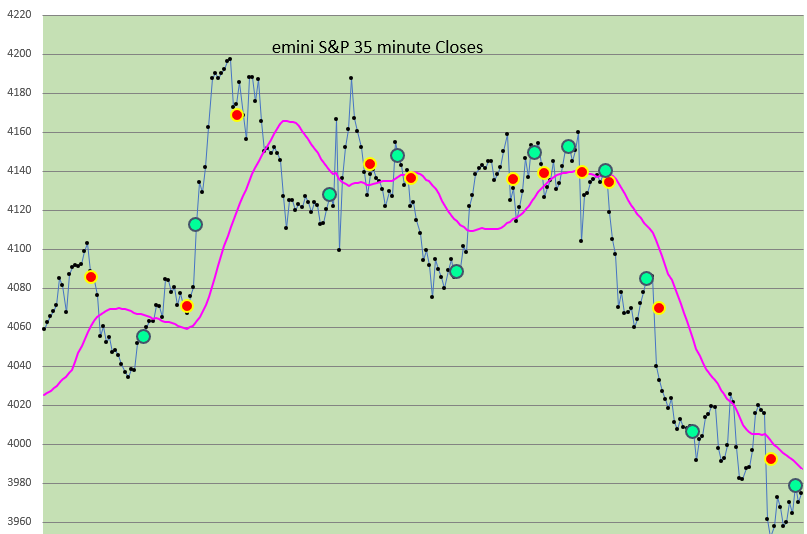

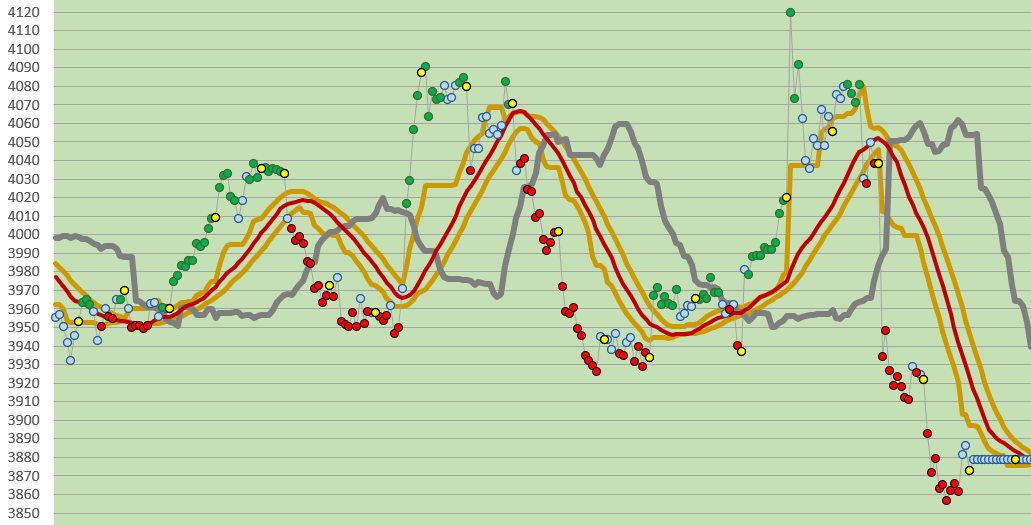

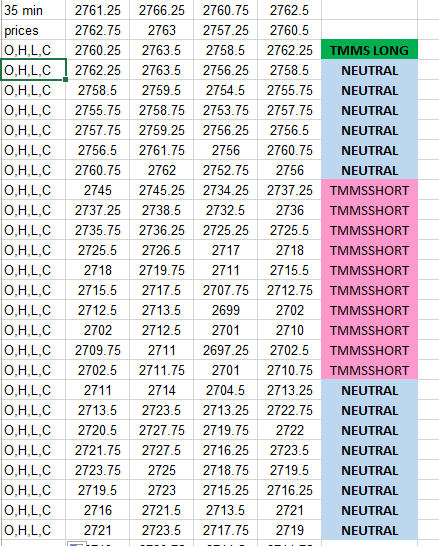

Here is an example of ACCELERATION BANDS with shading (using 35 minute price data, this represents 4-5 days activity):

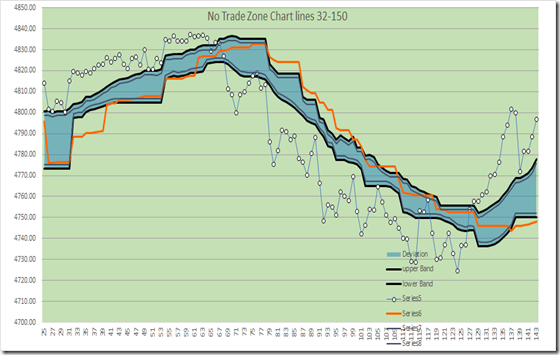

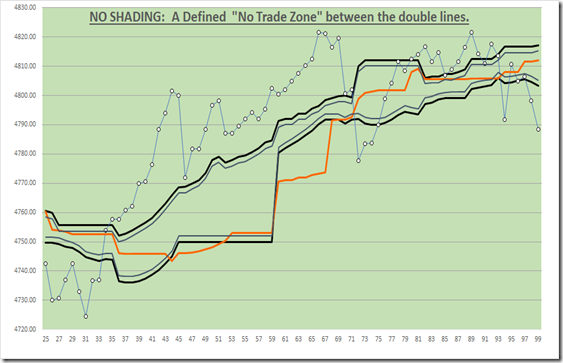

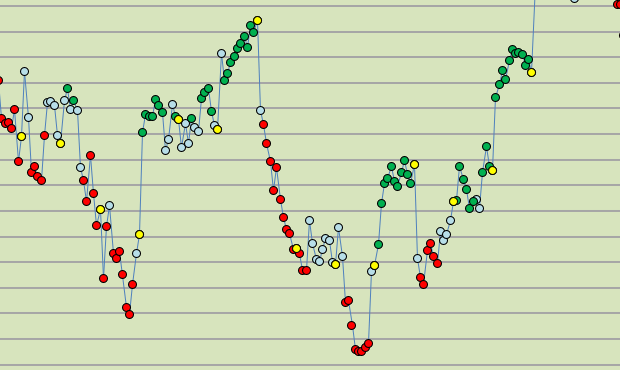

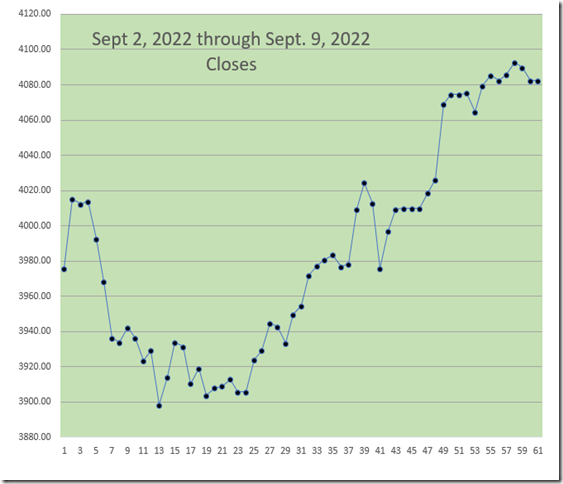

Here is a regular Excel Chart (not shaded).: (Since we use 35 minute bars, or 12 bars a day, this represents 5-6 days of Price Activiity.)

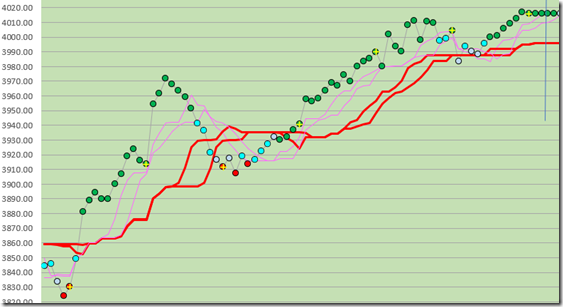

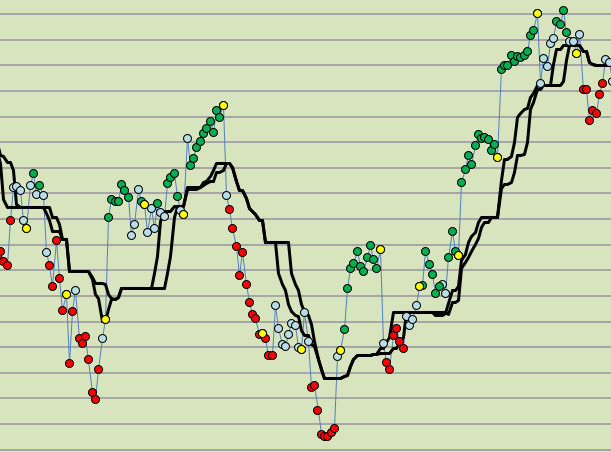

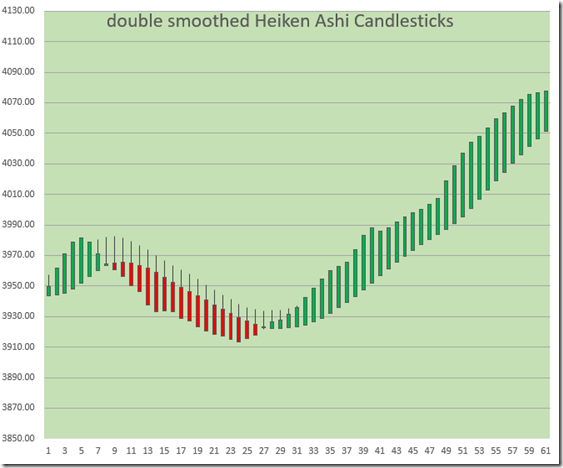

And here is a Shaded Area Excel Chart, (using the same price data as above) which highlights the “No Trade Zone” (which is a neutral or “out” area). These are essentially Permission Boundaries. The Shading assists with Profit taking and helps avoid foolish trades, and excess trade losses when prices move against you. THE SHADED AREA IS A “no permission” type boundary zone.

All of your charts can be visually accentuated and highlighted in your Excel spreadsheet if you know how to shade an area between 2 Lines. (And of course, you can even shade more than one area and between more than 2 lines if you wish to pursue that end also.)

Here is the Excel Spreadsheet to Download: (no macros and no VBA):

Updated version Feb 4, 2024 has a new example worksheet.

Good Luck With Your Trading!

contact us at therivertradingsystem@gmail.com

You must be logged in to post a comment.