Using Microsoft Excel as a Primary Trading Tool

We use the Heiken Ashi for trend direction, with Excel calculations, because Emini trading requires new ways of looking at price information, and that’s what Heiken Ashi does. Using a Heiken Ashi formulation for your price bars will help to diminish much of the “noise” or volatility that you would see with normal Open, High, Low, Close bars.

This is one way to determine the market direction or trend. (Remember, we are short/medium term trend traders, using intra-day 35 Minute price bars, which means we trade often but are not day-traders.)

Here are directions for setting up an Excel example yourself: (the actual Excel file is at the end, to download).

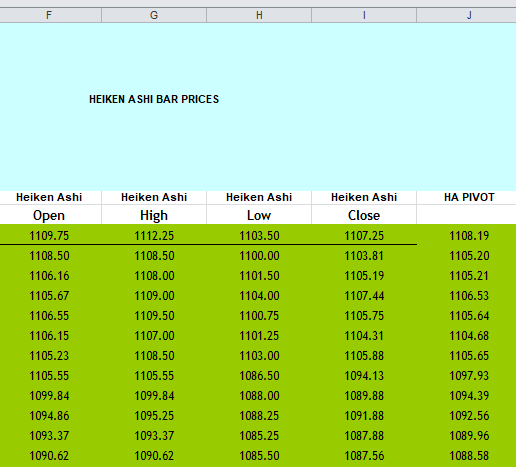

Heiken Ashi will be abbreviated to HA from now on. In Excel, start with 5 columns, Col A, Col B, Col C, Col D, Col E, in which you place your normal Date, Open, High, Low, and Close values. Then, in the next 5 columns to the right, Col F,Col G, Col H, Col I, Col J, create your HA formulations to create Heiken Ashi bars in this manner, specifically as HA Open, HA High, HA Low, HA Close, and Pivot HA.

The first (topmost) HA row (in Col F, Col G, Col H, Col I, Col J) is the same as the normal Open, High, Low, and Close.

Below that, in the second HA row, Start with the HA Close, in Column I, calculated as (Open + High + Low + Close)/4

Col F: HA Open=(PreviousHAOpen + Previous HA Close)/2

Col G: HA High = MAX(High, HA Open, HA Close)

Col H: HA Low = MIN(Low, HA Open, HA Close)

Col I: HA Close = (Open + High + Low + Close)/4

Col J: Pivot HA = (HA Open + HA High + HA Low + HA Close)/4

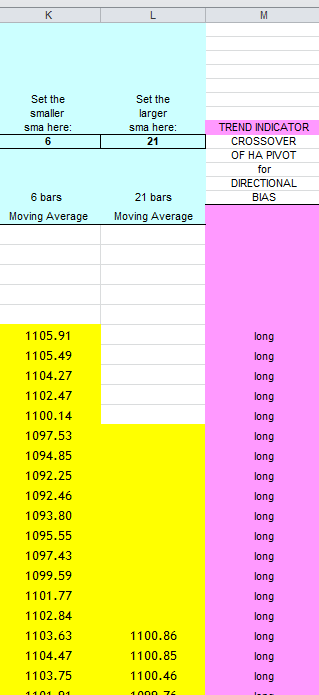

Your first goal is to arrive at HA price bar values and then calculate the Pivot HA. With the Pivot HA, the second goal becomes the calculation of moving averages of the Pivot. This gives you your primary “long”, or primary “short” direction signal. This is how you can determine your Directional Bias.

We prefer using 2 moving averages of the Pivot HA as a crossover to determine Primary Trade Direction.

Column M (above) is your TREND DIRECTION.

Remember, we use 12-bars-a-day (35 Minute bars), and this method of finding the trend can be the basis of your Primary Trend Direction trades.

Here is an Excel file which demonstrates (no macros, no VBA):

WANT TO SMOOTH YOUR HEIKEN ASHI with Excel? See our Sept. 2022 post.

Please see our archives for more free downloads of OTHER METHODS OF TREND DETECTION, such as DOUBLE SMOOTHING YOUR HEIKEN ASHI, how to create EMA WAVES, and how to create KAMA (Kaufmann’s Adaptive Moving Average). These are also good ways to detect and follow trends.

and Good Luck with your trading!

contact us at:

therivertradingsystem@gmail.com